When GST was launched in 2017, it was hailed as a pathbreaking reform — a “one tax, one nation” solution meant to replace a patchwork of indirect taxes and reduce opportunities for corruption. But over time, many critics and practitioners have argued that in practice, GST has merely shifted the locus of discretionary control rather than eliminating it. The complex rules, procedural ambiguities, thresholds, and multiple layers (CGST, SGST, IGST) have created fertile ground for corruption, evasion, and harassment.

In theory, GST was supposed to standardize tax rates and simplify compliance. But in reality, rent-seeking behavior, fraudulent input tax credit (ITC) claims, bribe demands, and delayed clearances have persisted — in many cases, shielded by weak oversight or administrative capture.

Let’s review documented cases, systemic weaknesses, and the lived consequences for ordinary taxpayers.

Documented Cases & Recent Scandals in GST

Here are significant instances and patterns of corruption or fraud under GST, drawn from media and enforcement records:

Some cases from 1st party/Social Media:

GST Officials Harass Poultry Feed Business Over Non-Claimed ITC – Click Here

A poultry feed additive company, whose products are largely tax-exempt, reported harassment by GST officials for not claiming Input Tax Credit (ITC).

Although some raw materials and finished products attract 18% GST, the company intentionally did not claim ITC due to the complex mix of taxable and exempt goods. Despite this being a legitimate business choice, officials issued a notice demanding penalties for not claiming ITC — a move experts say reflects bureaucratic overreach and lack of understanding of GST law.

The incident underscores how GST officers’ arbitrary actions are creating fear and financial strain for compliant businesses.

GST Officer Demands Bribe for Cancellation Approval – Click Here

A taxpayer shared a #GST corruption story detailing how their GST cancellation application — filed on 19 April 2025 — was stalled for four months despite timely responses to official queries.

When the applicant finally visited the department, an officer reportedly said:

“Aapko pata nahi kya fees lagti hai? Cooperate karo, 10 minute mein approval ho jaayega. Otherwise, keep visiting.”

The remark implied a bribe demand for quick approval, exposing how bureaucratic corruption and deliberate delays in the GST system are used to extort compliant taxpayers.

Massive Land Scam Involving UP State GST Officers – Click Here

In Uttar Pradesh, nearly 50 State GST officers are under investigation for allegedly purchasing benami (illegally held) land worth over ₹200 crore. – Click Here

Preliminary inquiries have uncovered documents showing large-scale land deals, with most transactions routed through a prominent builder in Mohanlalganj. So far, 11 officers have been directly linked to multi-crore property acquisitions, suggesting widespread corruption and money laundering within the GST department – Click Here

Kannauj UP – Click Here

- ₹54 Crore GST Refund Scam – Delhi

Delhi’s Anti-Corruption Branch (ACB) uncovered a scam in which GST refunds (i.e. the government repaying tax credits) were fraudulently claimed. A GST officer and six associates were arrested in connection. - Bribe Demand from GST Officer — ₹45,000 in Noida / Palwal

A GST inspector in Haryana (Palwal) was caught taking ₹45,000 as a bribe for a pending tax assessment. - Massive Fake ITC / Invoice Racket — DGGI Visakhapatnam

The Directorate General of GST Intelligence (DGGI) exposed a ₹643.81 crore GST fraud network, centered on fake invoices, shell companies, and fraudulent input tax credit claims. - Kingpin Arrest – ₹33 Crore Fraud Using Fake Entities

In Madhya Pradesh, the Economic Offences Wing (EOW) arrested Vinod Kumar Sahay for orchestrating a ₹33 crore GST fraud using multiple bogus firms. - Jodhpur Fake Firm Gang – ₹524 Crore Loss

A forensic bust revealed a gang across 22 states that created 240 fake firms to carry out bogus transactions, causing a ₹524 crore revenue loss. - Iron Trader Fraud – ₹26 Crore Loss

In Chhattisgarh, an iron trader was arrested for using ten fake companies and fictitious purchase records to claim ₹26 crore in fraudulent ITC. - Kerala: Arrests with No Prosecutions

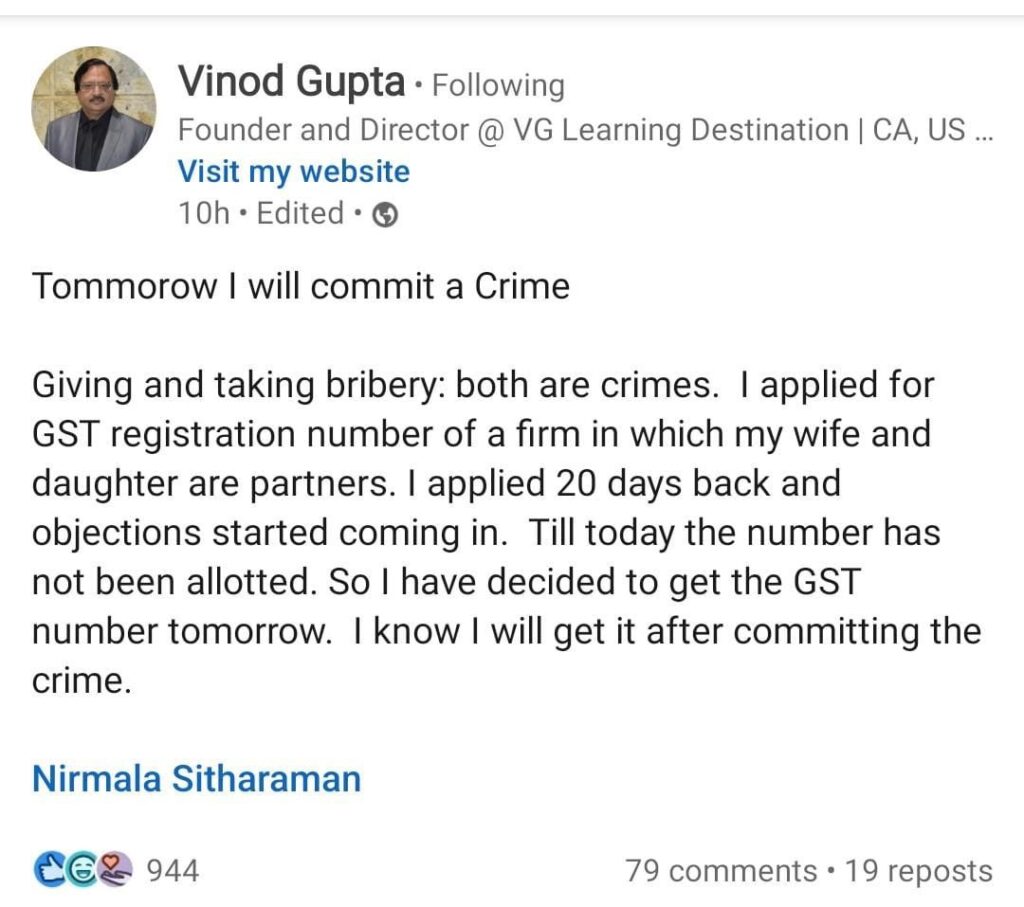

In Kerala, despite 14 arrests for large GST fraud (each over ₹5 crore), none have proceeded to trials or recovery. The state’s special court for GST cases reportedly lacks prosecutors, stalling justice. - Alleged Corruption in GST Registrations

A LinkedIn post accused CBIC’s executive officers of corrupt practices in the GST registration process. The post claimed top officials are unaware of ground realities. Finance Minister responded, denying impropriety but acknowledging registration delays. - Kerala’s Fake Registrations & Revenue Leakage

Opposition leaders allege thousands of bogus GST registrations, collusion, and revenue loss. They claim that officials, finance department actors, and political appointees are complicit. - UT State Officials in Bribe Trap – ₹7,500 NOC Demand

While not strictly GST, a state tax officer and assistant were caught taking ₹7,500 bribe to issue NOCs for stalls — this illustrates the ethos of small-scale corruption in tax administration.

These are not isolated or anecdotal. They reflect systemic vulnerabilities.

Why Accountability Fails: Systemic Weaknesses

Corruption in GST (and tax systems broadly) persists for several structural reasons:

1. Discretion & Ambiguity in Rules

GST involves many subjective judgments — classification of goods and services, applicability of inverted rates, whether a transaction is interstate or intrastate, whether credits are valid, whether a refund is genuine. That discretion, unless tightly audited, is a tool for extortion.

2. Complex Procedures & Compliance Burden

Despite promises of simplification, GST compliance is still intricate: returns, matching invoices, reconciliations, reverse charge, annual returns, audits, assessments. For small businesses, navigating this complexity often forces dependence on middlemen who may solicit illicit payments.

3. Weak Enforcement & Prosecution

Even when corrupt practices are exposed, legal follow-through is weak. In the Kerala example, arrests were made but no trials. The pipeline from investigation to prosecution is clogged by lack of capacity, political interference, or lack of will.

4. Capture & Collusion

In many states, tax departments become enmeshed with local trade interests. Officials may benefit from corrupt alliances with traders, making them hesitant to crack down. Fake registrations, collusive tax evasion, and mutual protection emerge from institutional capture.

5. Low Risk, High Reward

For many dishonest players, the chance of detection is low and penalties are often minimal. The expected returns of corrupt behavior may far outweigh the perceived risk, especially when enforcement is passive or delayed.

6. Legacy Issues & Import Overlaps

GST is a consumption tax, but many imports still fall under legacy customs and excise rules. Importers may face bribe demands, duty classification ambiguity, and delays. GST alone can’t solve corruption rooted in the older import / excise era without a holistic realignment.

The Human Cost: Harassment and Looting of Ordinary Citizens

While high-value frauds make headlines, the real damage is often on small businesses, traders, and ordinary citizens who can’t fight the system. Examples:

- Small traders forced to pay “facilitation fees” to avoid harassment during audits or show-cause notices.

- Cash demands during GST assessments under threat of penalty.

- Delayed refunds — small firms often run out of working capital while waiting for legitimate credit/ refund.

- Arbitrary disallowance of input tax credit or wrongful demand of interest/penalty when minor errors are found.

- Traders intimidated into accepting lower margins or paying off middle agents to reduce friction.

These practices undermine trust in the tax system and push informal business further underground.

Overhauling Legacy & Import Laws: What Must Change

To meaningfully curtail corruption and harassment, reforms must go beyond the GST framework:

- Merge Customs, Excise, and GST systems into a unified digital tax platform

A fully integrated system where imports, manufacturing, and consumption are tracked end-to-end, reducing gaps that corrupt actors exploit. - Algorithmic risk assessment, and minimal physical intervention

Use AI and data analytics to flag only high-risk transactions for inspection, rather than blanket checks that provide cover for bribery. - Strict timelines & mandatory written orders

Any reassessment, penalty, denial of credit or refund should come with written justification, within fixed time limits, and an appeal route. - Independent appellate tribunals with teeth

Fast, empowered tribunals (not overburdened courts) to adjudicate tax disputes, reduce delays and arbitrary rulings. - Transparent audit trails & public dashboards

Show data on pending cases, audit outcomes, status of refunds — making it harder for discretionary abuse to hide. - Whistleblower protection and reward

Tax officials, auditors, citizens who expose corruption should be legally protected and adequately rewarded. - Penalties and career consequences for corrupt officials

Proven malfeasance should lead not just to suspension, but blacklisting, criminal prosecution, and severe penalties. - Support & safeguards for small businesses

Simplified returns for micro enterprises, faster refunds, assistance desks to reduce dependence on middlemen.

Conclusion: From Reform Myth to Institutional Reality

Over eight years after GST’s launch, it is clear that structural reforms alone — without vigilant enforcement, transparent oversight, and cultural change — cannot erase corruption. The documented scandals, media exposés, and social media complaints show that GST’s promise is subverted by rent-seeking.

Unless those who enforce tax laws are held accountable, empowered systems are built with minimal human discretion, and ordinary taxpayers are protected from coercion, the tax system becomes another arena where the powerful exploit the weak.

For genuine tax justice, we need not just new laws — we need institutions fit for purpose, courageous enforcement, and public transparency. Only then can GST be more than a slogan and live up to its promise of fairness.